KOSPI Set to Break 4,600 on Semiconductor Surge

Outlook for the First Half and Volatility in the Second Half

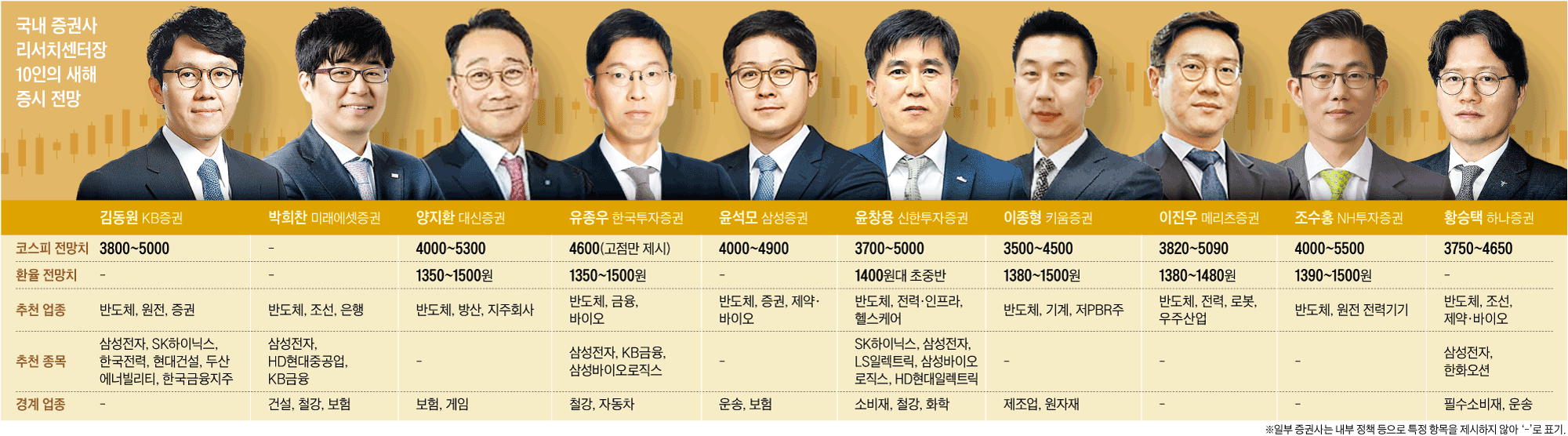

Analysts have presented a mixed outlook for the year, with a general consensus that the first half will be strong, while the second half may experience increased volatility. The primary reason for this optimism is the ongoing AI investment cycle, which is expected to significantly boost semiconductor profits. Additionally, enhanced shareholder returns through initiatives like value-up programs and revisions to the Commercial Act are seen as ways to address the "Korea discount." However, concerns remain about potential disruptions if U.S. President Donald Trump reignites trade disputes, U.S. inflation rises again, or debates over AI monetization intensify.

Lee Jong-hyeong highlighted that the earnings cycle centered on semiconductors is expected to continue, and with global liquidity expansion, an upward trend is anticipated in the first half. He warned, however, that concerns could grow in the second half regarding the slowdown of AI equipment investments and performance, along with increased volatility around the U.S. midterm elections in November.

Yoon Suk-mo from Samsung Securities noted that the stock price growth rate in the first half, when earnings visibility is high and expectations for liquidity expansion are significant due to issues like the Federal Reserve chair transition, is likely to be higher than in the second half. Yoon Chang-yong from Shinhan Securities predicted that the KOSPI would form a sideways "N-shape," rising, falling, and then rising again. He added that the peak is expected to be achieved in the second half rather than the first half.

Opinions varied on the timing and catalysts for potential lows. Yang Ji-hwan from Daishin Securities suggested that expanded uncertainty in U.S. economic and employment conditions could trigger adjustments in the first quarter. Lee Jong-hyeong pointed to the second to third quarters, when earnings forecast downgrades intensify, as a possible low point. Hwang Seung-taek from Hana Securities warned that adjustments may occur in the fourth quarter due to overlapping downward revisions in earnings estimates and weakened expectations for interest rate cuts.

Key Sectors Driving Earnings Growth

Earnings forecasts were cited as the strongest basis for additional KOSPI gains. Analysts generally projected that the KOSPI companies' earnings growth rate for this year would reach the late 30% to early 40% range compared to the previous year. Yoon Chang-yong stated that with AI expansion driving demand for semiconductors, power, and equipment, sustained export growth stabilizing the exchange rate, and falling oil prices, KOSPI operating profits are expected to increase by around 40% compared to the previous year. An aggressive forecast of over 60% growth in KOSPI operating profits was also presented.

Kim Dong-won from KB Securities mentioned that if the "three lows" boom—low oil prices, weak dollar, and low interest rates—continues, a scenario where both earnings per share (EPS) and price-to-earnings ratio (PER) rise together is possible. Combined with the government's capital market revitalization policies, KOSPI-listed companies' profits are expected to grow by 61.8% compared to the previous year.

Semiconductors were highlighted as the key driver behind the elevated earnings outlook. The center heads viewed the AI memory cycle centered on high-bandwidth memory (HBM) and the pricing trends of general-purpose memory as pivotal to KOSPI earnings levels. Hwang Seung-taek noted that semiconductors, with the highest earnings growth forecast for 2026, will continue to lead as the top sector. Reflecting this outlook, all 10 research center heads selected semiconductors as their recommended sector for this year.

Following semiconductors, shipbuilding, power and power equipment, and securities and banking (financials) were listed as promising sectors. Park Hee-chan from Mirae Asset Securities identified military ships and LNG carriers as key themes for the shipbuilding industry in 2026 and named HD Hyundai Heavy Industries as a top pick. Yoon Suk-mo highlighted the securities sector, stating that there is room for revaluation amid increased trading volumes and a favorable regulatory environment. Kim Dong-won emphasized the nuclear power industry as a promising axis, saying that this year could be the "first year of realization" with tangible progress in nuclear power projects like orders and groundbreakings. He recommended Korea Electric Power, Hyundai Engineering & Construction, and Doosan Enerbility.

Second-Half Variables: Tariffs, Inflation, and AI Monetization

Regarding AI bubble concerns, many analysts responded that while debates will continue, it is too early to predict a collapse. Cho Soo-hong said that it is premature to discuss an AI bubble collapse, as AI is an essential infrastructure that accompanies the redesign of social and economic systems. Yoo Jong-woo from Korea Investment & Securities viewed that while concerns about AI growth exist, they will subside as actual commercialization emerges from companies like Google and OpenAI. Conversely, Lee Jin-woo from Meritz Securities cautioned that as monetization and valuation debates intensify, distinguishing between winners and losers becomes crucial. Park Hee-chan also advised that while upward expectations dominate, preparedness for volatility risks is necessary.

Most analysts expected the won-dollar exchange rate to remain in the 1,400 Korean won range. Cho Soo-hong forecasted the rate to fluctuate between 1,390 and 1,500 Korean won, while Yoo Jong-woo (1,350–1,500), Lee Jin-woo (1,380–1,480), and Lee Jong-hyeong (1,380–1,500) shared similar views.

For asset allocation, the common advice was to maintain a base in stocks while incorporating bonds and alternative investments. Park Hee-chan suggested a global stock allocation of 60%, bonds 20–30%, and alternatives 10–20%. Lee Jin-woo also proposed a structure with stocks around 60%, bonds around 20%, and a portion allocated to alternatives (including gold) and cash.

Post a Comment