Recession Fears Rise as Economy Turns Red Before Tax-Bomb Budget

Economic Concerns and Political Tensions

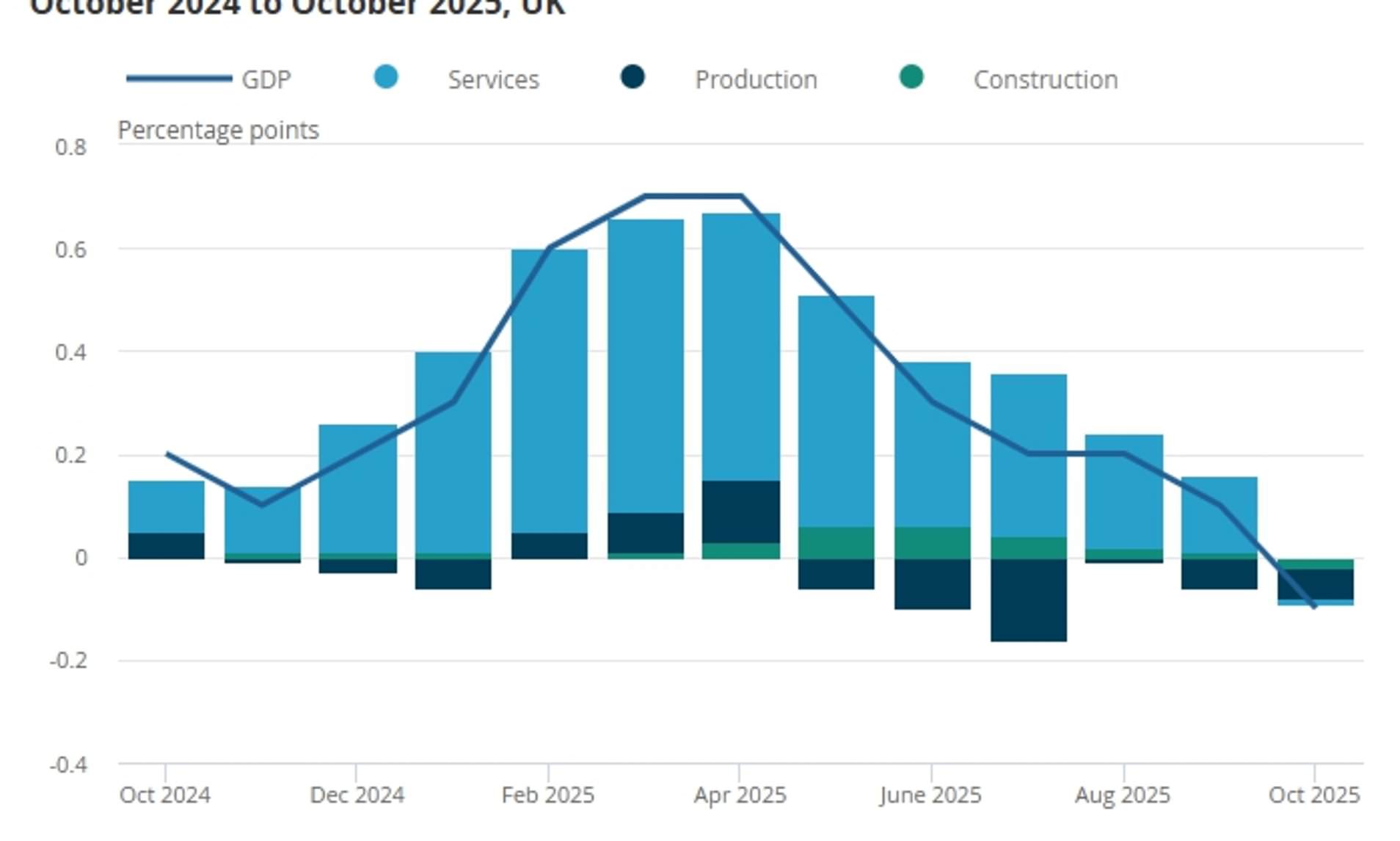

The recent economic data has raised significant concerns about the UK's financial health. Official figures revealed that the economy experienced a 0.1% contraction in October, which has fueled fears of a potential recession. This decline comes despite expectations of a recovery following a similar drop in September and a flat performance in August. The situation highlights growing anxiety about the impact of the Chancellor's upcoming budget, which is set to introduce substantial tax increases.

Chancellor Rachel Reeves has faced criticism for her approach to communicating the state of public finances. Some argue that she intentionally emphasized the dire economic conditions to justify her proposed tax hikes. This strategy has drawn sharp criticism from within her own party, with Labour's Treasury Committee chair, Meg Hillier, accusing Reeves of creating unnecessary turmoil in the markets.

Analysts had anticipated a 0.1% growth in October, expecting a rebound after the Jaguar Land Rover hacking incident caused a dip in September. However, the actual data showed a slight contraction, with production falling again and services growth stalling. Within the production sector, car manufacturing continued to show weakness, with only a minor recovery in October. Services, on the other hand, showed no growth, with declines in wholesale and scientific research offset by growth in rental and leasing and retail.

The Treasury has responded to these concerns by emphasizing its commitment to creating good jobs and investing in public services. The government has announced measures such as reducing energy bills, protecting infrastructure investment, and supporting major planning reforms, including the expansion of Heathrow and Gatwick airports and the construction of Sizewell C.

Despite these efforts, economists remain worried about the UK's economic performance. Jonathan Moyes, Head of Investment Research at Wealth Club, pointed out that the government's actions have undermined what little confidence the economy had left. He noted that the UK is lagging behind the US, where Q3 GDP growth is expected to be a strong 3.8%.

Suren Thiru, ICAEW Economics Director, warned that the economic outlook could worsen due to the impact of the Budget on business and consumer confidence. He suggested that the UK's economic prospects are likely to be weaker in the near term, with a growing tax burden and a weakening job market contributing to lower growth than expected.

Shadow chancellor Mel Stride criticized the government for its economic mismanagement, attributing the contraction to Labour's policies. He accused Rachel Reeves of misleading the public and breaking her promises regarding tax increases. He also highlighted the lack of a coherent economic plan under Labour.

Dame Meg, a Labour veteran, expressed concerns about the Treasury's handling of the Budget. She described the communication strategy as "throwing grenades" on the pitch, leading to confusion and volatility in financial markets. She emphasized the need for the government to be more transparent and careful in its messaging to avoid further damage to the economy.

The situation has led to increased speculation about the potential impact of the upcoming Budget on the UK economy. With the possibility of a recession looming, investors and citizens are closely watching the developments. The government must navigate the delicate balance between preparing the public and financial markets while maintaining the integrity of parliamentary processes.

In conclusion, the current economic challenges highlight the need for clear communication and strategic planning. The government's ability to address these issues will be crucial in determining the future trajectory of the UK economy. As the country faces mounting pressures, the importance of leadership and accountability cannot be overstated.

Post a Comment