Oracle: From Dot-Com Fossil to AI Giant

Oracle: A Surprising Force in the AI Landscape

For many years, Oracle has been viewed as a company that failed to keep up with the rapid changes in the tech industry. Since the dot com bubble burst in 2000, Wall Street investors have largely dismissed the company as a "has-been." During the 2000s and 2010s, Oracle's stock remained stagnant, with little to no growth in earnings. Meanwhile, other tech giants like Tesla and Meta captured the public's attention, while Oracle's co-founder and CEO, Larry Ellison, maintained a low profile despite his extravagant lifestyle.

Oracle’s Core Business and Legacy

Oracle's most well-known product is its "Oracle Database" management system, which serves as a central storage and control hub for companies. This system manages vast amounts of financial data, inventory records, and customer information. In addition to this, Oracle operates a legacy software business that involves maintenance contracts for its database software. This legacy business remains stable and profitable, but what truly drives investor interest is growth.

From Dot-Com Relic to AI Growth Engine

In recent years, Oracle has made significant strides in the cloud services market. The company entered the cloud business around a decade ago and has since become a strong competitor to industry leaders like Amazon Web Services and Microsoft Azure. Through its "Oracle Cloud Infrastructure," Oracle is now actively participating in the AI revolution.

What sets Oracle apart in the AI industry is its "full-stack" approach. The company acquires high-demand graphics processing units (GPUs) from Nvidia and provides them to its cloud customers. This allows Oracle to offer a comprehensive solution, from infrastructure to models and support, enabling customers to build and deploy AI applications seamlessly.

Oracle's Recent Earnings Report

Oracle's latest earnings report has sent shockwaves through the investment community. Initially, the stock dipped after the company slightly missed revenue and EPS expectations. However, the forward guidance was so impressive that it caused shares to surge by 35% overnight, resulting in a $244 billion increase in market cap and making Larry Ellison the wealthiest person on Earth.

Some key highlights from the guidance include:

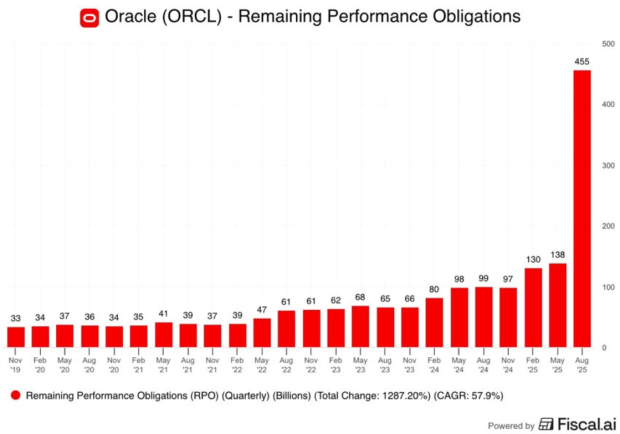

- A Massive Backlog: Remaining Performance Obligations (RPO), which represent contracts in backlog, skyrocketed to $455 billion, a 359% year-over-year increase.

- Four Billion-Dollar Deals: Oracle signed four contracts worth over a billion dollars with XAI, Meta, Nvidia, and OpenAI.

- Multi-Cloud Business Soars: Oracle's multi-cloud segment, which allows customers to work across different cloud providers, grew at an astonishing 1,529% for the quarter.

Can Oracle Live Up to Its Own Expectations?

Despite the impressive numbers, some skeptics question whether Oracle can sustain its growth and meet its own ambitious targets. However, historical data suggests otherwise. Oracle has consistently exceeded analyst expectations, beating Zacks Consensus Analyst Estimates in 15 of the past 20 quarters. The largest earnings miss in this period was just 3.74%, indicating that the company tends to be conservative in its projections.

Oracle Technical Analysis

From a technical perspective, Oracle's recent performance has been remarkable. Following the earnings report, the stock jumped 35%, with trading volume surging to eight times the average. The $43 billion in dollar volume traded indicates that institutional investors are rushing to acquire the stock. This kind of momentum typically lasts for months or even years, suggesting that Oracle's current success may not be a short-lived phenomenon.

Conclusion

Oracle's recent earnings report has undeniably changed the perception of the company. No longer seen as a relic of the dot-com era, Oracle has emerged as a major player in the AI revolution. With a growing backlog, a unique full-stack cloud approach, and a proven track record of exceeding expectations, Oracle is proving that it is far from being a "has-been."

Post a Comment